La inversión en oficinas en Madrid fue un 60% por encima de Barcelona, y la contratación de oficinas en alquiler fue de 570.000 metros cuadrados en la capital, frente a los 300.000 metros cuadrados en Barcelona.

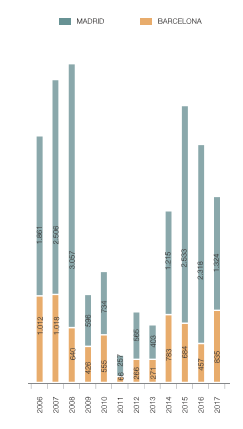

Madrid sigue siendo el mayor polo de atracción de capital en el mercado de oficinas. En 2017, la inversión en el mercado madrileño fue un 60% superior a Barcelona, hasta 1.324 millones de euros. Los inversores auguran un 2018 con mayor actividad debido a la posible rotación de activos de las SOCIMIs,que cumplen en algunos casos con el umbral de los tres años desde la adquisición de sus activos, y de los fondos value add para dar cumplimiento a su business plan.

En 2017 las operaciones de compraventa de oficinas alcanzaron un volumen de negocio en Madrid de 1.324 millones de euros y en Barcelona de 835 millones, acaparando la capital el 61% del volumen total agregado. Las inversiones en este tipo de activo durante el ejercicio pasado podrían haber sido significativamente mayores si se hubieran dado más oportunidades de inversión, debido al apetito tan grande de los inversores. En muchos casos, los propietarios se mostraron reticentes a vender activos inmobiliarios comprados en otro momento del ciclo debido a la dificultad de reinversión.

Fondos de inversión y SOCIMIs, la demanda más sólida

Los fondos de inversión fueron en 2017 los vehículos más activos en el mercado de oficinas, tanto en Madrid como en Barcelona. En Madrid más del 40% de la inversión total del año correspondió a fondos, que desplazaron, junto con las SOCIMIs, al resto de inversores durante la segunda mitad del 2017. En Barcelona, los fondos de inversión acumularon cerca del 37% de la inversión en la ciudad en 2017, siendo sin duda los grandes protagonistas del último semestre.

En cuanto a las operaciones más reseñables de los fondos de inversión, en Madrid destaca la venta del parque empresarial Isla Chamartín a Tristan Capital y Zaphir Asset Management por 103 millones, intermediada por Knight Frank; la adquisición del Palacio de Miraflores, ubicado en el número 15 de Carrera de San Jerónimo, por 60 millones de euros por parte de Remer Investment; el edificio Los Cubos, por Henderson Park y Therus Invest por 52 millones. En Barcelona destaca el sale & lease back de las oficinas y centro de diseño de Mango en Palau de Plegamans por 100 millones euros; y la compra de la antigua sede de la Generalitat de Catalunya en Fontanella 8, por parte de un inversor coreano por 64,7 millones de euros.

En cuanto a las SOCIMIs, cabe señalar los más de 100 millones de euros invertidos por Zambal SOCIMI en Albarracín 25, los 32,5 millones de la compra de Arturo Soria 336 y el proyecto de Josefa Valcárcel 40, comprados ambos por Colonial, y la compra por parte de Onix Capital Partners de Manoteras 12, operación intermediada por Knight Frank.

Los inversores institucionales se mostraron más activos en Barcelona. Concentraron el 23% de la inversión total gracias a la compra del complejo Luxa, por parte de Catalana Occidente, por 90 millones, que albergará la sede de Amazon.

En cuanto a las compañías inmobiliarias, sobresalen dos operaciones, ambas en la segunda mitad del año: la compra por Infinorsa del 40% de Torre Serrano en Madrid, y la del Parque Empresarial Can Ametller en Sant Cugat del Vallés por el Grupo Metrópolis, representando ambas el 10% de la inversión total en el segundo semestre.

Es oportuno indicar también el papel de los inversores privados durante 2017. Se destacaron las compras en Madrid de Fernando el Santo 15 por parte de José Lladó y, en Barcelona, la adquisición por Emilio Cuatrecasas (Emesa) de los números 444 y 632 de la Avenida Diagonal, sumando 31.000 metros del proyecto Finestrelles. El inversor privado o family office es un actor cada vez más sofisticado y profesionalizado, capaz de invertir en distintos segmentos inmobiliarios y así competir con inversores y fondos institucionales.

Se prevé que las SOCIMIs, con un papel discreto en el lado de la oferta, sean en 2018 uno de los actores con más actividad por el proceso de rotación de sus activos, que cumplen en algunos casos con el umbral de los tres años. También hay expectativas en los fondos value add, que cumplen con su plan de negocio a través de ocupación e incremento de rentas.

Precios y rentabilidades

El precio medio en el CBD de Madrid y Barcelona sigue la tendencia creciente observada en los últimos años. Madrid supera los 8.000 euros €/m², destacando la compra de la Torre Serrano por parte de Infinorsa, mientras que en Barcelona se han alcanzado los 6.900 euros/m², destacando la compra de Diagonal 444 por parte de Emesa. El precio medio más elevado del año se alcanzó en Madrid en la sede de Barclays en Colón 1, comprada por CBRE GI a Barclays por 14.000 €/m².

Las yields se han mantenido en niveles estables y muy en línea con otras plazas europeas, en torno al 3,75% en el mercado madrileño, debido a la falta de rentabilidad en inversiones financieras, y sobre todo por la fuerte expectativa de incremento de las rentas a medio plazo. Barcelona se ha mantenido niveles de alrededor del 4%, con previsión de igualarse a los niveles de la capital en cuanto usuarios e inversores perciban una mayor calma en la tensión política.

[Fuente: smart lighting]