El volumen de inversión directa en activos inmobiliarios en España alcanzó un total de 3.750 millones de euros en el tercer trimestre de 2018, lo que supone un incremento del 84% con respecto al mismo trimestre del año anterior.

Así lo refleja el informe ‘At a Glance‘, elaborado por la consultora BNP Paribas Real Estate, que describe la situación de la inversión en España en activos inmobiliarios durante el tercer trimestre de 2018.

De esta manera, el volumen de inversión acumulado en 2018 alcanza 7.760 millones de euros, ligeramente inferior al registrado en el mismo periodo de 2017 (-4,2%).

Según BNP Paribas, la falta de producto en venta, unido a las elevadas pretensiones de algunos propietarios, son dos factores que están generando que muchas operaciones no lleguen a materializarse.

Los fondos de inversión siguen siendo los principales compradores. Sus operaciones han representado el 65% del total transaccionado durante el tercer trimestre del año.

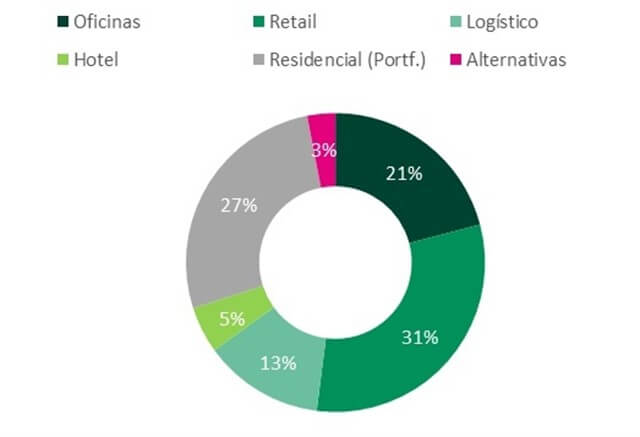

Por otro lado, el retail sigue siendo el sector que mayor cuota de mercado acapara, con un 31% del total de la inversión. El volumen invertido en activos comerciales durante el tercer trimestre asciende a 1.140 millones de euros. El volumen acumulado del año supera los 3.000 millones de euros.

En segundo lugar, se mantiene la inversión en portfolios residenciales, que ha alcanzado un volumen de 980 millones de euros en el tercer trimestre del año. Se observa un interés muy elevado, por parte de los principales fondos de inversión oportunistas, por adquirir carteras de viviendas provenientes, en muchos casos, de los balances de entidades financieras o “servicers“.

A diferencia de los primeros meses del año, la actividad en el mercado de oficinas ha retomado impulso. El volumen de inversión registrado en el tercer trimestre ha ascendido a 770 millones de euros. La rentabilidad Prime del mercado de oficinas se mantiene en el 3,25% en Madrid y 3,50% en Barcelona.

Por último, la inversión directa en naves logísticas en rentabilidad ha repuntado considerablemente durante el tercer trimestre. El volumen de inversión registrado en el tercer trimestre ha alcanzado los 475 millones de euros. Esta cifra responde principalmente a la compra por parte de Blackstone del portfolio de naves de Grupo Lar por 100 millones de euros y a la reciente compra por parte de Tritax de la nave de VGP que ocupa Mango en Barcelona por 150 millones de euros.

[Fuente: El Economista]